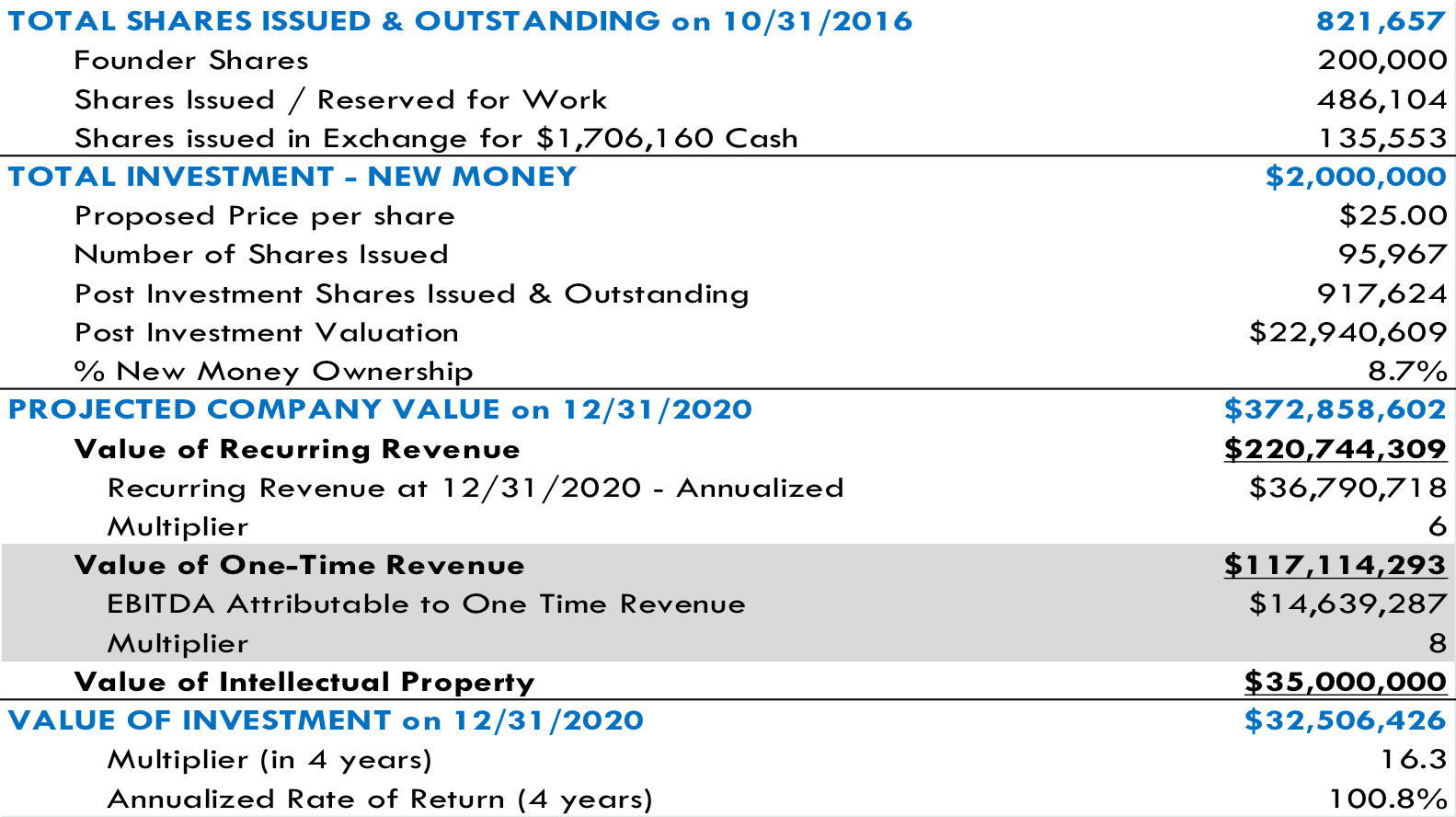

Investment Details

And here are the details of the investment opportunity:

All stock is Common stock

820,000 shares of common stock are currently issued.

200,000 are founder shares.

486,000 were issued or are reserved for work.

135,000 were issued in exchange for $1.7 Million in cash.

Regarding the Financing:

BluBØX seeks to raise $2 million to fund its growth and expansion in the market.

No further investment is anticipated through the plan’s 4 year horizon.

At $25.00 per share, the new money investor will own 8.7% on a fully diluted post-investment basis, representing a $23 Million post-investment valuation.

Regarding the Return on Investment:

The company’s valuation at the end of year 2020 is anticipated to be $372 Million.

$220 Million is contributed by the value of the Annualized Recurring Revenue

This is equal to the $36 Million in Annualized Recurring Revenue times 6.

The 6 multiplier is a high industry average for high quality recurring revenue.

$117 Million is contributed by the value of the “Engine” that produces the One-Time Revenue and the associated Recurring Revenue trail.

This is equal to the EBITDA produced by the One-Time Revenue times 8.

The 8 multiplier is justified by the fact that every $1.00 of newly installed equipment will produce, on average, 40 cents of recurring revenue every year after.

$35 Million is contributed by the value of the Intellectual Property

This estimate is based upon the price paid in our previous company for similar but very inferior IP.

This all yields a multiplier of 16.3 on the new money, or a 100% annualized rate of return over 4 years.